Money Market Fund

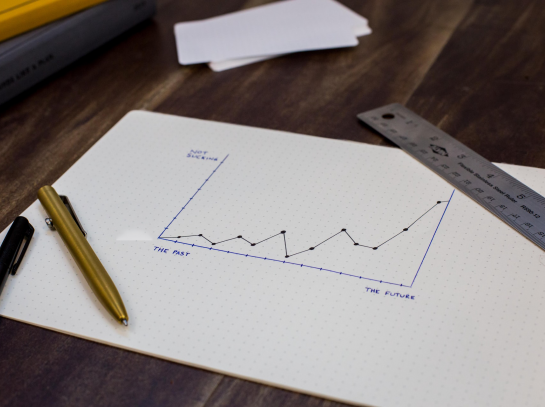

More often than not, you will have some money you do not have immediate use for or you intend to use it in a few weeks or months. These funds could be your emergency funds or next year’s school fees for your children.

Where do you put such funds?

A money Market Fund is an ideal low risk investment that preserves your capital and offers you a higher return than a regular savings or fixed deposit account.

A Money Market Fund is a collective Investment Scheme offered by Fund Managers licensed and regulated by Capital Markets Authority (CMA).

A Fund Manager sets up a Money Market fund as a separate entity and pools funds from many investors. They invest the funds in in short term deposits such as treasury bills, commercial paper and bank deposits that mature in less than 12 months. By investing prudently and negotiating competitive rates, their returns usually are higher than the 91-day Treasury bill.

A money market Fund earns interest daily, depending on the market’s dynamics. You receive a monthly statement showing how your investment is performing.

Why you should consider setting up a Money Market Fund

At Retirement Solutions we help you Invest your surplus cash or emergency fund now and watch your savings grow.

Get a Money Market projection now!